This material dates back to 2011, obtained from a course run through Tarek El Diwany’s IslamicFinance.com website. Apologies for the upside view of some of these slides, please rotate to view correctly

LEARN: More on Islamic Finance structures

Posted: February 1, 2023 in Islamic FinanceTags: Islamic Banking, Islamic Finance, Tarek El Diwany

LEARN: Islamic finance structures and overview

Posted: February 1, 2023 in Islamic FinanceTags: Islamic Banking, Islamic Finance

Material can be found here pertaining to an overview of the Islamic Finance industry and particularly the common legal structures which make up the products offered. This detail is dated, originally obtained in 2008 however some of the origins of the data may even precede that

READ: Paper Promises, Debt, Money and the New World Order

Posted: December 23, 2022 in Debt, Monetary System, Paper moneyTags: fiat money, Monetary System, Paper currency

Philip Coggans text explores the more recent history of our fiat and debt based system whilst also putting it in a broader historical context. The author tries towards the end to envisage where this may lead to in the coming future

I favor this text because it is written in an accessible style and it full of anecdotes from history showing the breadth of knowledge on display here

I attach my marked up copy and also draw out some of my key points;

- The framing of current and historical conflicts about money being about the interests of debtors verses creditors

- Page 41, Classical approach to stimulus was to start a war….this is still an approach taken today, think of the new markets and the industrial revolution brought about through new conquests, today’s precious commodities or competitive advantages brought about by invasions, regime change or aggressive political measures not far from violence

- The fact that there is no solution to heavily indebted nations woes, they have become stuck, only debt forgiveness or a radical change of leadership can begin to address these hardwired problems. There are no other resolutions to this crises, but plenty of tinkering and rescheduling of terms to lull borrowers into a state where they believe progress is being made

- Page 61, reference to the circumventing of interest prohibitions in the Muslim world

- Rules of global finance traditionally set by the largest creditor nation, previously this has been Britain, and later the US, in future could this be China? What could the financial works look like then?

- Page 113, note the two points stated here 1) How social welfare policies came about against the theory that labor could be satisfied through conventional supply and demand mechanics 2) How championing free trade and few tariffs was largely for the benefit of a nation which would cash in from selling its products to a wide range of consumer nations. This would not suit those nations which would be harmed by the competition from outside forces

- Page 121-123, this parts recalls the situation the most powerful nations found themselves in the early 20th Century, and their attempts to kick start world trade (to the extent it would benefit them) and to keep the game going albeit under a new set up, since the current status had broken down and was not longer fit for (their) purpose.

- To me this indicates how global constructs will continue to be re-imagined each time a crises severe enough to warrant it occurs. There have been a couple in recent times (2007/8, 2020) which we are still to see the full consequences of, but make no mistake, when those nations with enough self interest deem it appropriate radical changes will be set in motion.

- The main challenge will be the number of powerful nation now playing the game and their conflicting agendas which could mean a lack of cohesive solutions and indeed further conflict

- Page 130, note how the Marshal plan for Europe was an example of ‘enlightened self interest…created vast markets for US Exports…’

- fascinating overview of the post 1930s and post 1970 eras when the battle between monetarists and Keynesian

- Page 161 touches upon the disadvantages of different currency exchange systems compared to a gold standard

- Page 163 rightly raises the issue of asset valuations and how reliable they are in good times and bad.

- Following this point on page 165, the author brilliantly questions what wealth and being asset rich really means, particularly where it comes to owning property

- Another valid criticism of the GDP ratio on page 212 is that is compares activity (revenue) and not wealth (assets) with debt

- A note on an assumed link between population growth and economic growth from page 254

- Chapter 12 – Paying the bill, is a recommended chapter to read alone if needed. It explores a number of solutions, or as they are assessed they could be called non-solutions.

What makes an effective currency?

Posted: September 21, 2022 in Monetary System, Paper moneyTags: Bitcoin, Currencies, fiat money, Gold, Islamic Finance, Monetary System, Money, Money Supply, Paper currency

In my opinion there are three main ingredients to an effective and durable currency base in current times

Confidence from Power

Exchangability

Infrastructure

These may differ from some of the purposes of currency which are a means of exchange, a store of value and a unit of account, but the topic of this piece is specific to what gives any form of money it’s authority and effectiveness

Conventional currency may be fiat – created from nothing, largely intangible with no instrinsic value but everyone buys into that fiat. We know that confidence, is a key factor that makes it work. This follows its acceptance by participants, and tied closely to this is the interchangeability of this currency with other forms of money and assets.

This point is paramount – the participant has confidence that whether they fully have faith in it or not, they know they can use it to buy in/out from this into real assets, such property, land, metals, or into alternative currencies, even something which has some infrastructure to allow access to it although is itself not real such as bitcoin or cryptos generally.

Full confidence is not a prerequisite. One just needs to know you can buy in and out, that is what is meant by trust or confidence.

Confidence is backed by something else that is vital – power and violence, ‘men with guns’. This comes with a precedent – a history of violence, in the modern case, European colonialism.

The knowledge that there is power behind the words and symbols, and that it has been seen before or that we know violence can happen because the ability and intention exists.

This point must be examined against Cryptocurrencies, who will back up crypto (with the necessary power)….clearly the amount of volatility shows that no one will. The price highs are apparent because there is infrastructure – accessible mechanisms with which to buy and sell this asset. People know that they can get in and get out, however they need to be careful because there’s no protection when the floor gives way….as it has done frequently.

Creating your own currency can work but it will only be done within a silo….participants will need to know and accept that there is limited control, no interchangeability and no protection or real power behind it. Although if enough people buy in it can work on this limited basis. However, the fact that this currency cannot be protected from outside forces, it can relatively easily be forged and will have no value in interchanging with other assets, hence the necessary acceptance by participants that it’s operation is entirely within this flimsy silo.

It has appeal as a practical alternative but the essential missing ingredients of power and exchange means it will always be short lived.

Gold when viewed from this perspective also shows up some vital flaws in todays world. Historically it had the element of power behind it…indeed the lesson of the massive hoards of gold transferred from Latin America to European shores by the Spanish and Portuguese empires reflects the very power and violence used to take it and make use of it in the first place.

It’s exchangeability holds firm even today with plenty of infrastructure and demand to make this work. However some key control elements are missing, so much of it is owned by a few nations who are the only ones who have a realistic ability to use it as a currency to any scale. This also leaves open the ability of those other large holders to compromise any gold standard with their own holdings, and buy into this eco system from the sidelines.

Of course historically we saw gold currency minted under specific names/authorities therefore the ability to differentiate one’s gold currency base or even dilute it when supply is low has much precedence. Ownership indeed points to power, and where these two are lacking I can’t see how any gold standard can take root. The Islamic gold dinar will remain a historical relic where this point holds true.

These are my own thoughts, I’d welcome any reflections from others in order to validate this stance

VIEW: The Corporation

Posted: January 12, 2022 in Consumerism, Economics, Geo Politics, Imperialism, PovertyTags: Colonialism, Economic Development, Money, The Corporation

The history of the formation of an entity as a persona, to its contemporary and perhaps future guises.

A history of deceit, manipulation, waste and destruction

The most interesting aspect of this part, was that it was released during the Coronavirus pandemic and touches upon a number of observations witnessed at the time.

A number of these concern AI and current tech trends, so it provides a good overview of the contemporary business, although it doesn’t go into great depth.

Graeber on the real origins of money

Posted: December 26, 2021 in Debt, Islamic Finance, Paper moneyTags: Adam Smith Institute, David Graeber, Debt, Islamic Finance, Money

A short clip here from the late great David Graeber, recovering some of his material from his work ‘Debt: the first 5000 years’

The following points are important:

- The origin of free markets linked to Islamic history (listen at 24 minutes), an enabling factor of this is shariah law itself which is outside of a ‘state’/government. In addition, because there is no state apparatus fierce competition is not the main driver but transactions are done on the basis of mutual aid.

- The barter story is a myth, no anthropological evidence exists to support this

- The only way two parties can understand an equivalent value is where a monetary system is already is existence thereby assigning some concept of value

- Money’s existence has been linked to violence and war

- The origin of much of Adam Smiths theories have their place in works by Al Ghazali, as well, I may add, Ibn Khaldun

This text by Michelle Murphy looks at global population growth over the last century, and how this has been identified as something which needs to be managed for the sake of the global economy.

Beneath the surface of this premise, the author points to a number of motivations which have dictated the very nature of this discourse and the underlying reasons as to why this debate even exists today

“The economisation of life…was a historically specific regime of valuation hinged to the macrological figure of national ‘economy’ ” Page 5

“…the history of the economisation of life is part of the history of racism and the technoscientific practices of demarcating human worth and exploiting life chances.” Page 6

“….this new era of calculative practices designated both valuable and unvaluable human lives: lives worth living, lives worth not dying, lives worthy of investment and lives not worth being born.” Page 7

The history of such designations is vital for understanding how the continued racialized and sexed devaluation of life inhabits ubiquitous policies, indices, calculations, and orientations that perform new kinds of racialization even as they reject biological race as such. Moreover, this history puts questions of reproduction at the centre of how capitalism summons its world.” Page 7

Also in the authors’ own words; “…I argue that the economization of life was generated at this encounter between Cold War and postcolonial social science, at the crux between imperialism and decolonization, and in the tension between experiment and governance.” Page 9

The main themes and topics covered can be summarised as this:

- Eugenics in the colonial period to population concerns in decolonial nation states

- Tied in with economic management within the bounds of the new global infrastructure of control – nation states and transnational organisations; Population and the Economy (Pearl and Keynes), creation of war-time production measures – GDP

- Population concerns become globalised – development projects, NGO’s, global aid programs, contraception programs – rolled out across countries, Bangladesh and Pakistan as particular test cases for these studies, p78, 86/7, foreign policies

- Valuation of life itself – based on race

- Market research to gather data, thick data, experiments, educational theory and economic theories tie to these.

- Preventing births, educating a child, investing in a girl

I attach my copy of this text with my highlights

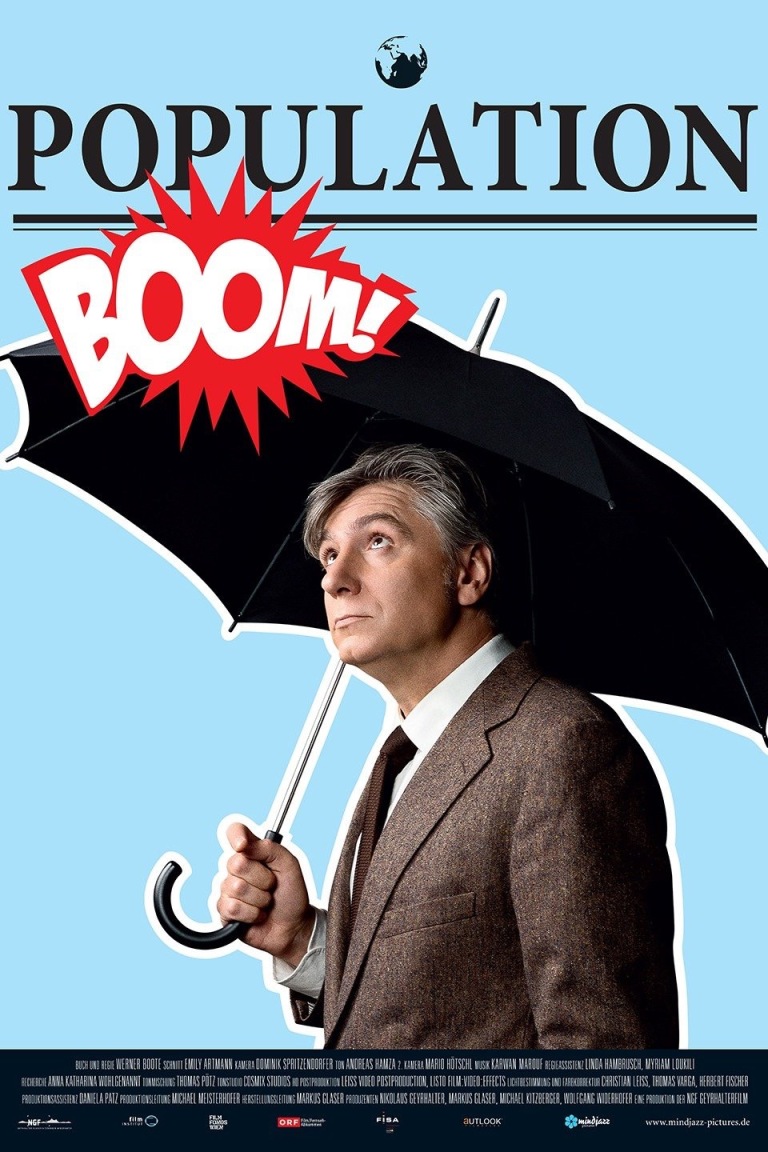

I also suggest viewing this recent documentary which also covers the same broad subject area although stops short of coming to the same conclusions and only barely touches upon the same underlying causes

This article serves to highlight the way in which this topic continues to be used as a smokescreen for something more sinister. The misplaced belief that there is a genuine natural concern at hand when in fact it may be another means of hegemonic control

https://www.aljazeera.com/opinions/2021/12/1/why-are-white-elites-afraid-of-black-babies

I have listed a number of my main learning points and particular highlights of the text here;

- Idea of expanding populations globally and the threat to resources and the planet is how it is usually framed in the mainstream. This text asks if this is as innocent as this seems or are there deep-rooted prejudices and imperialist agendas tied in with this thought, and how have these manifested in global actions over at least the last 100 years – post colonial times, prior to this is out of scope of this text

- The author sets the scene here by exploring the dual concepts combined in this subject matter; Population and Economy, “Together population and economy have rearranged worlds over the twentieth century. New ways of valuing of life have been tied to their fates. Population and Economy have been built into the architectures of nation-states where practices of quantification have helped to install economy as our collective environment…” Page 1

- It is important to note the link to, or rather the evolution of, Eugenics work in the early 1900’s, into Population as a concern which needed full spectral governance

“While eugenics – orientated toward nationalist, colonial, and racial evolutionary futures – would dominate to horrific genocidal effect in the 1940s, during the decades that followed it was the epistemic practices that tied together economy and population that would flourish as both a U.S project of foreign aid and as postcolonial projects of nation-states” Page 13

“The problem of population, as a figure of aggregate life, was replete with methods of governing brown, black, poor, and female bodies that recast racial differences in terms of economic futures. Economic futures now depended on designating over population as a kind of surplus life that was better not born. Race did not have to be named in order to enact racist practices”

- There is reference to the origins of the measure of GNP, later GDP, the origins of which are tied to war;

“The first calculation of annual gross national product (GNP) for the United States was produced in March 1942 in a Bureau of Foreign and Domestic Commerce report called “War Expenditures and National Production”

- A reference to the work of Charles Mills (author of The Racial Contract) is quoted here

“…Mills shows how race logics, manifest in nineteenth-century European colonialism and American slavery, carved zones of exception from the liberal political versions of economic man through racial dehumanizing…Even more perniciously, the racial logics of liberal political frameworks authorized the enslavement of people as property and the legality of stealing from, kidnapping, injuring, raping, and killing racialized less-than -human life. Economic life was thus constituted through the violent extractions of extraeconomic life. In other words, GDP has many ghosts Page 26

- A valid question is posed around the capturing of paid activity within an economy, and thus “how does one capture the wealth of the nonmonetized work of living, surviving and caring for others that makes up the bulk of human activity?” Page 28

- Of particular note is also the advent of collecting and measuring masses of data, the precursor to what is now termed ‘Big Data’ can be traced back to what the author refers to as ‘thick data’ gathered on masse in colonies by imperialists as a means of control. Ties to the origins of modern day data harvesting, the technology available now but the process was in existence for the last 200 years

“Development measures became their own extrastate industry with cadres of social scientists gathering data, running sample surveys, crunching numbers, executing experiments, and feeding indicators. Poor countries become data rich” Page 30

- This text makes clear the origins of state aid and their entangled nature with imperialist designs and foreign policy;

“…General William Draper, concluded that supplying arms and military training…was not sufficient.. Draper’s report unexpectedly called for economic assistance combined with population control…It is this report that recommended the founding of a single agency to administer foreign aid, giving birth to the United States Agency for International Development (USAID)” Page 35

“…South Asia singled out by U.S foreign policy as a site of threatening overpopulation. In the now declassified 1974 report Implications of Worldwide Population Growth from U.S Security and Overseas Interests commissioned by Kissinger, Bangladesh, India and Pakistan were listed at the top of a priority list of ‘Countries where the imbalance between growing numbers an development potential most seriously risks instability, unrest, and international tensions” Page 64

- The debate on population has its origins in systematic racism;

..in the United States the demographic transition was decidedly animated by fear of a future with too many of ‘them’ that would derail the American good life of capitalism and white supremacy” Page 46

“Population is used as a neutral term that abstractly describes a multitude: a group of individuals and the total number of inhabitants. In the late twentieth century, when scientists were looking for language to replace race as a kind of biological grouping, population offered a term seemingly devoid of claims to racial difference” Page 135

- The involvement of the RAND organisation and the Rockefeller name within this history is important in connecting to other entanglements

It’s worth keeping note of a number of key personalities within the history of this debate;

- Raymond Pearl; American biologist who initiated an experiment in 1920s with fruit flies in a bottle which extrapolated on a global scale his findings on the ‘law’ of population.

These finding were promoted at the inaugural World Population Conference of 1927, an event which was designed to propel new international focus of this issue.

Pearl was trained in biometrics at UCL (UK) a pivotal crossroads for both statistics and eugenics as disciplines.

“Pearl remained a committed racist, and continued to believe in a struggle for existence between races as they came into friction through colonialism or immigration” Page 11

- John Maynard Keynes; famous economist who wrote The General Theory of Employment, Interest and Money on macroeconomics

“..incubated during Keynes’ time as a colonial bureaucrat and applied economist in London’s India Office” Page 20

Keynes was a treasurer of the Cambridge University Eugenics Society, and in 1946 described eugenics as “the most important, significant and …genuine branch of sociology that exists”

- Harvard anthropologist, Mahmood Mamdani “…would draw on this research to write The Myth of Population Control, accusing the Khanna project of being an imperialist sham” Page 71

- Lawrence ‘Larry’ Summers, former President and Chief Economist of the World Bank, did the maths and cost benefit analysis of either distributing contraception verses educating young girls and “…concluded that education was $3,000 cheaper than contraception for verting birth. Education was as effective as birth control” Page 113

VIEW: Recommended Documentaries

Posted: February 5, 2021 in Debt, Economics, Fractional Reserve Banking, Imperialism, PovertyTags: Breakpoint, Capital in 21c, Capitalism, Monetary System

VIEW: System Error

Posted: January 25, 2021 in Debt, Economics, Monetary System, Poverty, StatisticsTags: Debt, Economic Development, economic measures

Another recommended watch from me…note the following themes;

- Economic growth verses natural growth – the two inevitably will collide

- GDP, the prominent yardstick by which all performance and national success is measured, originated in wartime. It was the industrial production measure during the world war and continued afterwards…another explicit link between the economic system and WAR

- GDP does not measure incomes in a society, therefore a lot of low wage work producing a lot will show as a positive result under GDP

- It is noteworthy how different spaces are being used to crack new markets for growth, to push the boundaries of any limits, once traditional land and labour and materials were exhausted, financial deregulation and credit came in for expansion, then the online space of the web, and now we see more drumming up of the space beyond our physical planet…

- Without continued growth, debt itself cannot be paid back (remember the interest charge grows exponentially….you will get negative or stagnant growth…what does this then signify?

VIEW: Origins of Capitalism; Slavery

Posted: January 22, 2021 in Economics, Imperialism, PovertyTags: Capitalism, Eric Williams, Plantation, Racism, Slave Trade

The origins of capitalism – the exploitative discriminatory system that pits those with capital or the means of capital against those without – is best shown in transatlantic slavery

Capitalism is usually associated with historical trade in general, which is false. It is an entirely different beast and must be recognised as such.

Please view these two lectures which reference and explore the link of modern day capitalism and the transatlantic slave trade further

A notable work which underpins both these videos are Eric Williams: Slavery and Capitalism

The second video is particularly good, detailing some of the hidden truths around the British and Slavery